Globally, only 10% of venture capital (VC) investments go to startups founded or co-founded by women. This was revealed in a study by the Boston Consulting Group (BCG), in collaboration with MassChallenge, an international accelerator network. The study involved investors, entrepreneurs, and accelerators to analyze the causes of this disparity and propose concrete solutions.

MassChallenge, active since 2010, has supported over 1,500 companies, helping them raise more than $3 billion in funding and create over 80,000 jobs. It focuses on supporting women-led startups—not through equity or loans—but through mentorship and strategic resources.

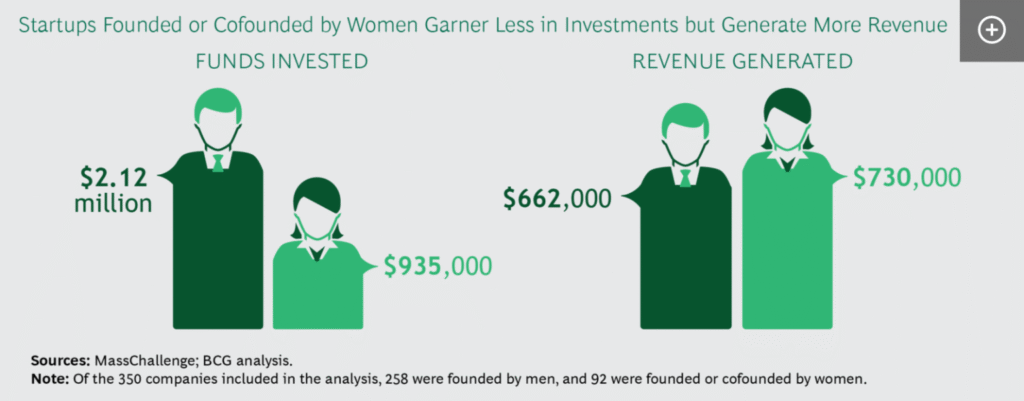

The Numbers Are Clear: Women-Led Startups Perform Better

According to BCG’s analysis:

- Women-led startups receive an average of $935,000, less than half the $2.1 million received by male-founded startups.

- Yet they generate 10% more cumulative revenue over five years: $730,000 vs. $662,000.

- For every dollar invested, women-led startups return 78 cents, compared to just 31 cents from male-led ventures.

Other studies, including one from BCG on innovation, confirm that teams with more women in key roles achieve better outcomes. Yet these companies still receive less financial support.

Causes of the Gender Gap in Venture Capital

Three key factors explain the disparity:

- Cultural bias – Women founders are judged more harshly and considered less capable, especially in technical and strategic roles.

- Cautious communication style – Unlike men who often present aggressive forecasts, women tend to be more conservative. This is misinterpreted as a lack of ambition.

- Limited familiarity – Many male investors (who make up about 90% of the VC sector) lack understanding of sectors dominated by women-led startups, like health, childcare, and beauty, making it harder to evaluate their potential.

The Harvard Business Review also confirms that performance data does not support these stereotypes.

How to Close the Gap: BCG’s Recommendations

1. For Venture Capital and Investors:

- Acknowledge and correct unconscious biases in investment decisions

- Include more women in decision-making roles

- View women-led businesses as strategic opportunities—less competition, better performance

2. For Accelerators and Incubators:

- Ensure gender balance among applicants

- Actively promote women founders and mentors

- Build connections between women-led startups and women-friendly investors

3. For Women Entrepreneurs:

- Use data to strengthen pitches and strategies

- Find mentors with VC experience to refine presentations

- Be more assertive in asking for funding and support

According to the Wharton Social Impact Initiative, there are currently around 50 funds focused on women-founded businesses, with over $1 billion in capital.

Jenny Abramson, founder of Rethink Impact, notes that women received more funding 20 years ago than today. Yet it is well established that diverse teams produce superior results. The next wave of successful businesses will be driven by a combination of mission and inclusivity.

The European Landscape: Still a Challenge

In Europe, the scenario is similar. According to PitchBook data:

- Of €16.35 billion invested in VC deals, only €1.84 billion (11%) went to startups founded by women

- Women make up just 9% of decision-makers in VC firms

Bridging this gap requires intentional and coordinated action. Acknowledging the biases is the first step. Changing the system will take time, but immediate steps can be taken through mentorship, inclusion, and awareness.

In Summary:

The gender gap in investment is real—but it’s bridgeable. Women-led startups are a strategic opportunity for those willing to look beyond prejudice and invest in true innovation.

If you believe in the potential of women entrepreneurs and want to be part of the change, discover RestartHer Academia: a network that supports, educates, and connects founders and professionals to build solid, conscious, high-impact businesses.